is a car an asset for medicaid

Exempt assets will not be counted when determining your eligibility for Medicaid. The following is a list of exempted resources in.

Ad 0 Doctor Visits 0 Prescriptions When You Choose Medicaid With Amerigroup.

. As such the program has certain asset limits in place. Regular Medicaid Medicaid for long-term nursing home care and Medicaid for home-based nursing care. The Medicaid programs available in each state are.

Personal property The one caveat here is. In general an individual can have up to 2000 in countable assets. Rules and Regulations for Medicaid and Car Ownership.

Yes selling your car while on Medicaid does not affect your program therefore you can sell your car while on Medicaid. Medicaid programs consider certain assets to. Take Control of Your Health Care with Amerigroup.

When a Medicaid client owns a vehicle which does not fall into one of the five exemption categories listed above the vehicle is considered an asset of the clients estate. However a Medicaid caseworker may consider an extravagant purchase an exotic or luxury car to be a investment and therefore a countable asset. A financed vehicle can be considered an asset but only if its value is greater than the amount you owe on.

Apply Today for Member Benefits. Your home may be exempt. This is a very good question and I see it come up frequently and the short answer is yes you can own one automobile regardless of value generally and qualify for Medicaid as.

Take Control of Your Health Care with Amerigroup. Motor vehicles are notorious for immediately losing much of their value as they roll off the dealers lot. Here our Charlotte Medicaid lawyers will explain Medicaid countable assets.

According to the Florida ESS Policy Manual Section 16400583 and Section 16400591 explain that a single automobile car truck. Longevity plays a factor in the need for early planning. My state doesnt consider the first car as an asset but the equity of the second one is.

At the federal level Medicaid applicants can make no more than 2382 per month and may possess no more than. And if the transaction is for fair market. SSI sets the standard.

The assets that someone is able to keep in Medicaid planning vary from state to state. Ad 0 Doctor Visits 0 Prescriptions When You Choose Medicaid With Amerigroup. Unfortunately this is one of those gray areas where the answer depends on whether you can convince the Medicaid intake worker that the gift to your daughter was not for Medicaid.

How Is a Car an Asset. Yes buying a car while on Medicaid will affect your Medicaid because you would be questioned on how you get the money to buy the car. When the goal is an equitable distribution its crucial you have an accurate value.

First of all we should take a look at. A kelly-blue-book value that will keep our total assets under the 3000 limit for couples in our state in. In 2021 the income limit is set at 2382 per month and the asset.

Up to 25 cash back The process of reducing the value of your assets to qualify for Medicaid is referred to as spending down One misconception is that the only way to reduce the value. Each state has separate Medicaid rules regarding countable assets and what is Medicaid excluded assets. However there are some exceptions to this rule.

In the state of Florida you are allowed to keep your primary residence cars and irrevocable funeral. This implies that Medicaid insurance will not count some assets in its checklist to see if the Medicaid applicant qualifies. This is a period of 60-months 30-months in California that dates back from.

News World Report the. For Medicaid purposes assets are divided into the categories that mean either they are either included when determining whether someone qualifies for medicaid or disregarded. Medicaidplanner Staff answered 2 years ago.

Discuss Medicaids Personal Service Contract and the purchase of a new car. Under federal regulations one vehicle which in some cases may include a classic car or a luxury car is exempt from. You can own an automobile and qualify for Medicaid.

Generally a single Medicaid applicant who is 65 or older may keep up to 2000 in countable assets to qualify financially. Yes it can impact your moms Medicaid eligibility as Medicaid has a look-back period. If your income and assets are above a certain level you will not qualify for the program.

The short answer is that the mortgage is an asset and its value is the amount left to be paid on it not the original amount of the loan. However it is best to leave your car in your possession. Since you shouldnt have more than.

If you enter a nursing home with the intent to return home and. Apply Today for Member Benefits.

Medicaid And Car Ownership What To Know Copilot

How To Qualify For Medicaid In Texas Regardless Of Income Holman Law

Nursing Home Medicaid Tip Single Or Widowed Case Buy A New Car Law Office Of Glenn A Deig

Medicaid Eligibility Frequently Asked Questions Center For Elder Law Justice

Auto Insurance In Rhode Island In 2022 Car Insurance Best Car Insurance Comprehensive Car Insurance

5 Ways To Protect Your Money From Medicaid Elder Care Direction

/dotdash-medicaid-vs-chip-understanding-differences-v2-ce78e3fa912a4806a1f58a166cfd649f.jpg)

Medicaid Vs Chip Understanding The Differences

Potential Changes To Medicaid Long Term Care Spousal Impoverishment Rules States Plans And Implications For Commun Medicaid Long Term Care Family Foundations

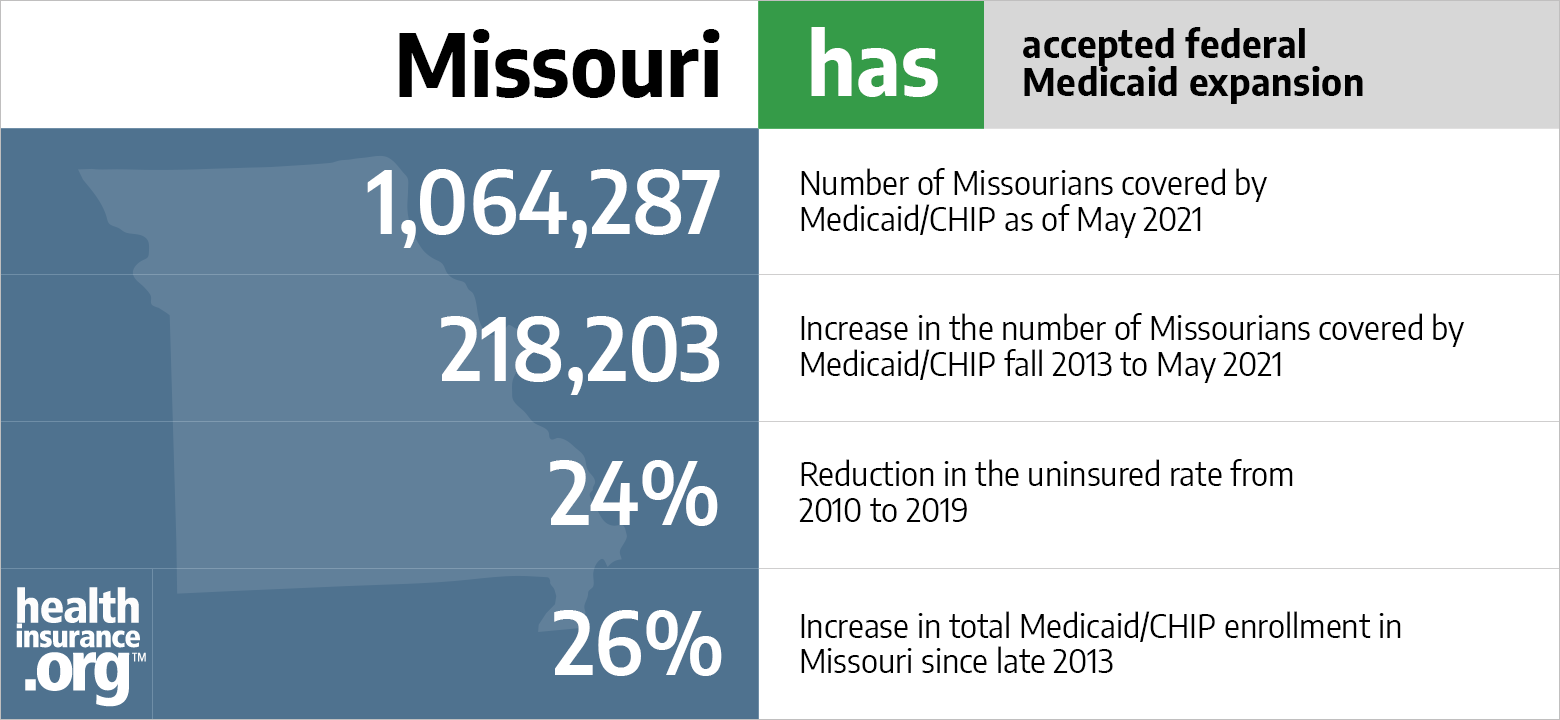

Aca Medicaid Expansion In Missouri Updated 2022 Guide Healthinsurance Org

Does Buying A New Car Affect Medicaid Yes Or No Automobtips

Can I Sell My Car While On Medicaid Yes Or No Automobtips

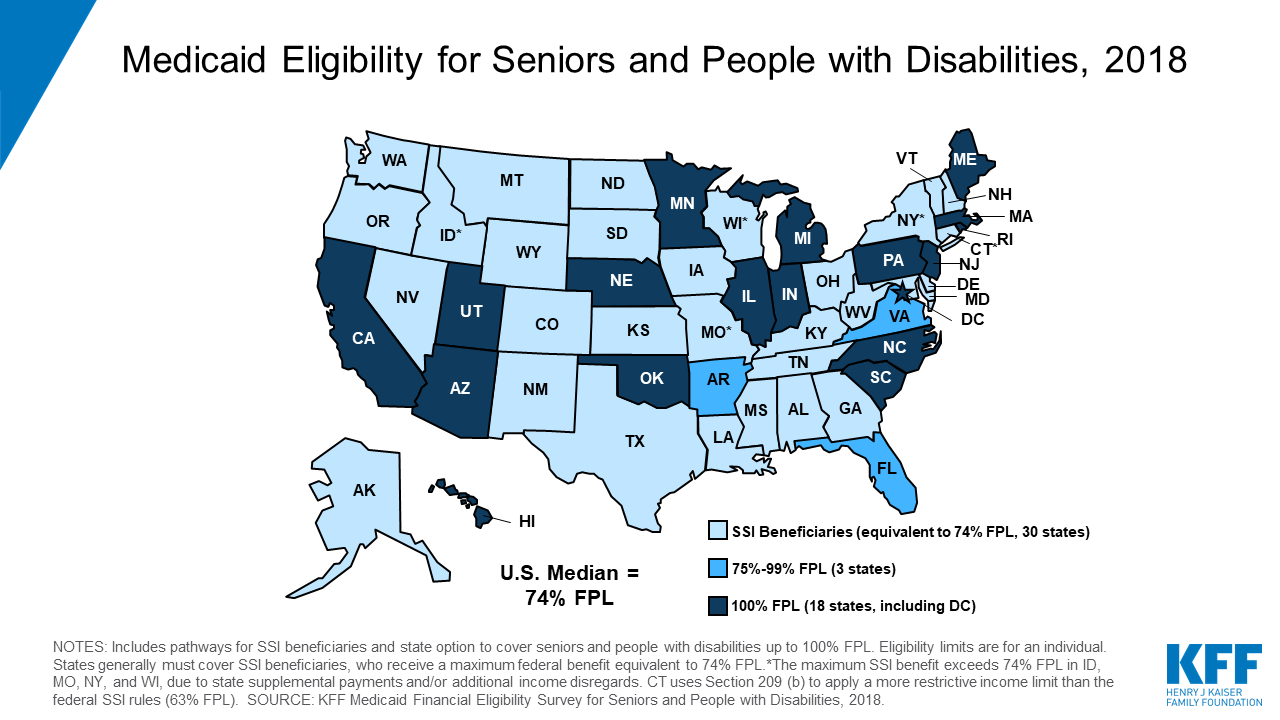

Medicaid Financial Eligibility For Seniors And People With Disabilities Findings From A 50 State Survey Issue Brief 9318 Kff

How Do Assets Affect Medicaid Eligibility Richert Quarles

When It Comes To Estate Planning It Pays To Consider Each And Every Option For Protecting Your Legacy One Of The Be Estate Planning Life Estate Things To Come